How we estimate the quotas for 2026-2031

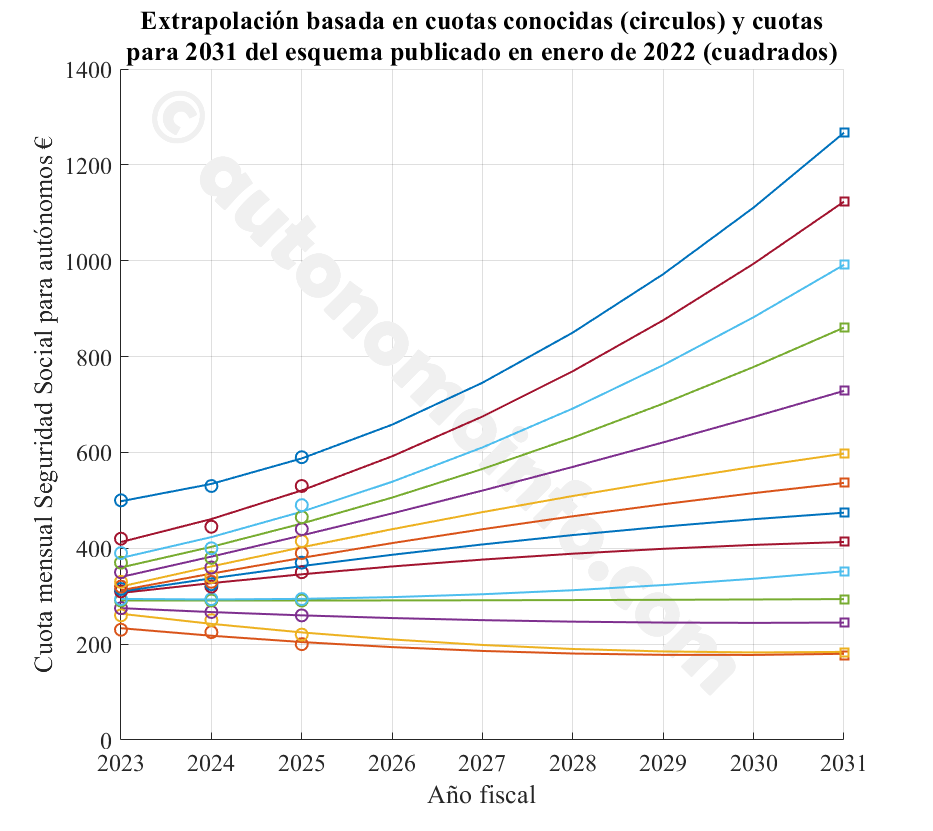

In 2022, the Spanish government set in motion a scheme to gradually increase the social security payments for self-employed over a transitional period of 9 years from 2023 to 2031. For now, the government has only published the new quotas for the years 2023-2025, while the values for the following years will not be known until 2025. Nevertheless, our calculator allows you to use fiscal years up until 2031, the last year of the transition period. Below we explain how this was achieved.Before the current scheme was approved, the government already indicated how they would like to increase the contributions until 2031 and the proposed scheme was published in an article in el País. While this scheme has since been replaced, it nonetheless provides an indication of where the government would like to be by the end of the transition period in 2031. So, to estimate the contributions for the years from 2026-2031, we used the quotas for the years already known (2023-2025), added the endpoints (2031) from the scheme in the el País article, and applied a least squares regression (best fit) of a second order polynomial to obtain the intermediate years 2026-2030. The result is shown below.

Clearly, these are highly speculative at this point and are only meant to provide an indication of where things might be headed after 2025...

Select what applies to you to determine your tax free allowance

Calculate your income tax and new social security contributions from 2023 onward as a self-employed in Spain

Click for more info on the Spanish self-employed system

If you are self-employed in Spain, until 2022 you would pay a fixed monthly quota between about €300 and €1250 to the social security system. The actual amount was not coupled to your earnings but could be chosen freely from within the above range; essentially the higher the quota you chose, the higher your benefits (sick pay, unemployment benefit, pension).

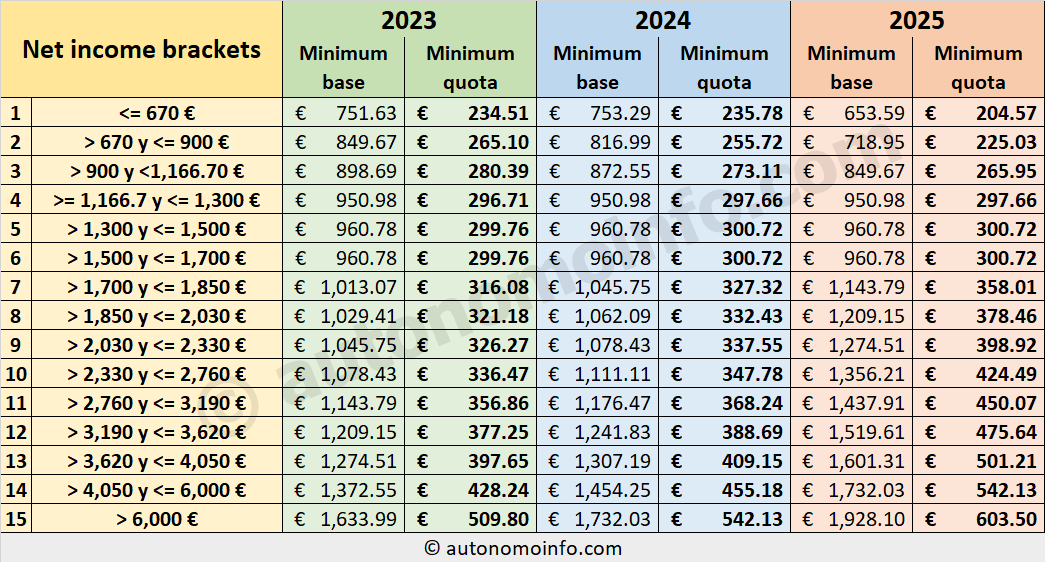

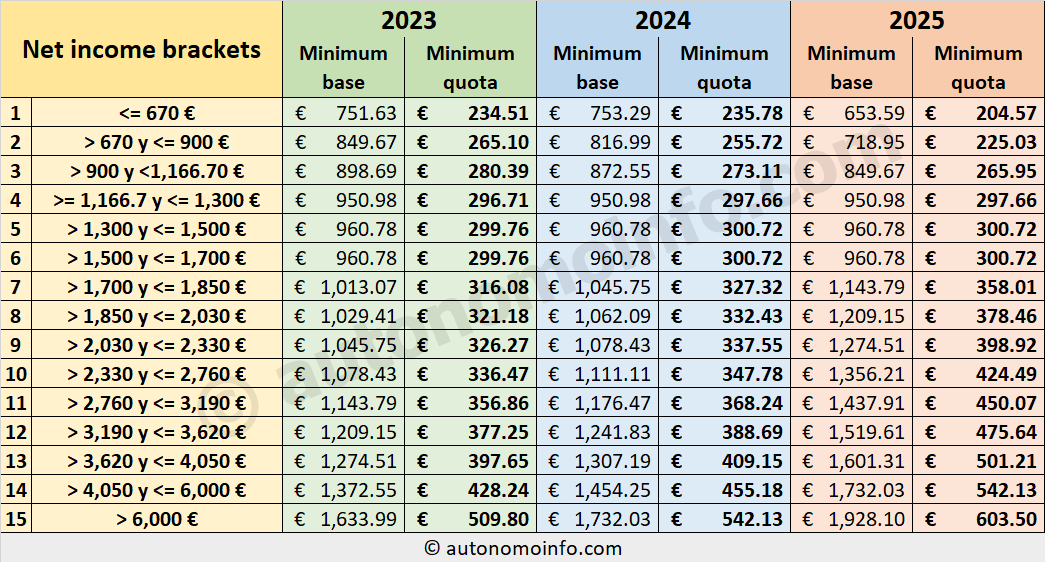

In 2022, the Spanish government set in motion a scheme to gradually increase the social security payments for self-employed over a transitional period of 9 years from 2023 to 2031. For now, the government has only published the new contributions for the next three years from 2023-2025. The main change is that in the new scheme the minimum social security payments are no longer decoupled from your income. Instead, the new scheme uses 15 fixed income brackets to determine your minimum social security contributions.

New minimum social security contributions based on monthly income brackets. Important: the "net income brackets" shown in this table already include the deduction for general expenses (of 7%/3%) and are thus different from the "net revenues" you enter in the form below.

Keep in mind that this calculator only provides an approximation because your income tax not only depends on your economic activity as self-employed but on your overall income, so if you have had other income (rent, shares, etc.) or also work as an employee, then the result shown here will only apply to your activity as self-employed.

In 2022, the Spanish government set in motion a scheme to gradually increase the social security payments for self-employed over a transitional period of 9 years from 2023 to 2031. For now, the government has only published the new contributions for the next three years from 2023-2025. The main change is that in the new scheme the minimum social security payments are no longer decoupled from your income. Instead, the new scheme uses 15 fixed income brackets to determine your minimum social security contributions.

Keep in mind that this calculator only provides an approximation because your income tax not only depends on your economic activity as self-employed but on your overall income, so if you have had other income (rent, shares, etc.) or also work as an employee, then the result shown here will only apply to your activity as self-employed.

Use this tool to calculate how much you have to pay in social security contributions and income tax with the new self-employed scheme introduced in Spain in 2023 and see how this affects your net income compared to the old scheme.

All content © AUTONOMOINFO.COM 2025