Self-employed vs Limited Company: A closer look

For many self-employed individuals, there comes a point where they wonder whether transitioning to a limited company might be a better option, especially after achieving sustained business success. While numerous online resources, often from Spanish accounting firms, suggest to make this shift once earnings hit the €40,000 to €60,000 range, it's important to take a closer look as these recommendations are not free from commercial bias considering that these accountancy firms obviously would like your business for setting up the company and then for managing your books and taxes.

What does it mean to have a company in Spain?

Before diving into a side-by-side comparison of the freelancer vs limited company model, let's clarify what it means to establish a limited company in Spain.

Company formation

As a self-employed professional, the legal entity that would typically apply to you when you form a company is the a so-called 'Sociedad Limitada Unipersonal' (single proprietor limited company, abbreviated as S.L.U.). Forming a company is comparatively cumbersome in Spain compared to other parts of the world, although formation times have significantly improved from up to 28 days only a few years ago to as little as 4 days through specialized companies who will charge you anything from €250 to 4-digit figures depending on the complexity of the formation (e.g., if you need customized company statutes for example).

While many steps of the formation process can now be handled online, you still need to personally visit (and pay) a notary and also a bank in order to open a company bank account. Typically, you'll remain registered as self-employed, transitioning from a regular autónomo to a so-called 'autónomo societario'. While both types of autónomo have the same obligations in terms of filing quarterly returns and paying the same social security quota, the key distinction lies in expense deductions: an autónomo societario can deduct 3% of gross income for general expenses without receipts, compared to 7% for a regular autónomo. Since both are capped at €2000 this difference only comes into play if your gross income is below about €67.000 because for higher incomes this deduction maxes out at €2000.

How to get paid as company owner

As company director, you can pay yourself as much as you want (within the company's financial limits of course). It is important to bear in mind though, that a company is a separate legal entity from you. This means that the company money is not yours to use as you please and you cannot simply use the company bank account to pay for personal expenses. Instead, there are 2 possible ways for you to withdraw money from the company:

- You invoice the company for your services, and/or

- You withdraw company profits in the form of dividends.

Typically, both are combined to optimize tax efficiency (see below).

Tax considerations

Many opt for a company structure to mitigate higher income tax (called IRPF in Spain) rates. The IRPF is a progressive tax. Using Catalonia as an example, as of 2024 income above €60,000 is taxed at 44% (22.5% at state level plus 21.5% at regional level), increasing to 46% for earnings above €90,000 (22.5% state and 23.5% regional). In contrast, companies enjoy a flat corporation tax of 25% (23% if your turnover is < €1 million), with additional taxes (capital gains, starting at 19.5%) on dividends.

Example: From every Euro that you earn above €60.000, as a regular autónomo you retain just 56 cents. If the same Euro would be registered as company profit, it is first taxed at 23% (corporation tax) and the remainder again at 19.5% (capital gains tax as you pay yourself the after-tax profit as a dividend), leaving you with 62 cents. However, since the capital gains tax is also progressive, for dividend payments between €6000 and €50,000, the tax rate is 21.5% which means that in this range you are left with 60.4 cents from every Euro. Still, you pay slightly less taxes on high incomes if you have a company. In addition, withdrawing company profits in the form of dividends is not subject to social security payments, which can generate additional savings.

Bookkeeping and tax filings

Operating as a company significantly increases administrative tasks, requiring separate bookkeeping and tax filings for both you, the autónomo societario, and the company. Considering the complexity of corporate tax law, many seek the help of professional accounting services, incurring further expenses (packages for small companies without employees start from about €800 per year).

Additionally, having to invoice your company involves VAT and income tax withholdings (15%), which affects your short-term cash flow as some money is always tied up in VAT and withholding tax (due to delayed VAT refunds and advance tax payments). You will note a particular difference in cash flow if most of your clients are private individuals or non-Spanish businesses as there is no withholding tax for regular autónomos for these types of clients.

Dissolving a company

Ceasing operations as a regular autónomo is straightforward and cost-free. However, winding down a company involves extensive paperwork and additional costs (notary).

Is it worth forming a company? The short answer: It depends.

Now that you know a little about what it means to have a company in Spain, let's look at whether it is actually worth your while. Of course this very much depends on the reason why you want to have a company in the first place. We will look at three of the most common reasons in turn.

Reason 1: You want to limit your personal liability

For self-employed individuals, personal liability is a significant concern. As a regular autónomo, your personal assets are on the line for any business debts or legal claims. This could mean risking all your savings and potentially facing personal bankruptcy in extreme cases. On the flip side, a limited liability company shelters your personal assets from business liabilities. In Spain, the company's liability is confined to its capital, which must be a minimum of €3,000. This protection does not extend to cases of gross negligence or fraudulent behaviour by the company's director.

However, mitigating personal liability doesn't necessarily require forming a company. Professional risk insurance can be an effective alternative, offering coverage for civil liability and legal assistance in client disputes. By doing some searching on the web, you can find insurance companies that provide an annual liability coverage of up to €150,000 for premiums as low as €238. If the primary reason for contemplating a company structure is to limit your personal liability, professional risk insurance may fulfil this need with less expense and hassle than forming and maintaining a company.

VERDICT: If your primary motivation for forming a company is to limit your personal liability, opting for professional risk insurance might be a simpler and more cost-effective solution.

Reason 2: Your earnings are starting to exceed €50.000 and your accountant told you that you can pay less taxes by forming a company

To evaluate this claim, a direct comparison between the self-employed (regular autónomo) and company (autónomo societario plus SLU) models is helpful.

Financial Comparison: Regular Autónomo vs. Limited Company

| Autónomo | Company |

|---|---|

| Here, you are a regular autónomo, which means that you pay progressive income tax and social security contributions on 100% of your net profit. | In this model, you are an autónomo societario and you manage your compensation through a mix of invoicing your own company for services (keeping this amount moderated to sidestep higher income tax brackets and lessen social security contributions) and extracting the remaining profits as dividends (subject to capital gains tax but not to social security contributions, leading to potential savings). |

For simplicity, let's consider a scenario involving a single person without dependents or disability, tax resident in Catalonia.

Example 1: Net profit of €40,000

| Autónomo | Company | ||

|---|---|---|---|

| Income | € 40,000 | Income (you invoice your company)* | € 33,000 |

| Income tax (IRPF) | € 8,911.25 | Income tax (IRPF) | € 6,815.85 |

| Social security | € 4,664.31 | Social security | € 4,173.33 |

| Civil liability insurance | € 238.00 | Company bookkeeping | € 800.00 |

| Remaining profit in company | € 6,200.00 | ||

| Corporation tax on profit (23%) | € 1,426.00 | ||

| Left to take out as dividends | € 4,774.00 | ||

| Captial gains tax on dividends | € 930.93 | ||

| Total tax | € 8,911.25 | Total tax (IRPF+Corp.+Cap. gains) | € 9,172.78 |

| NET take home | € 26,186.44 | € 25,853.89 | |

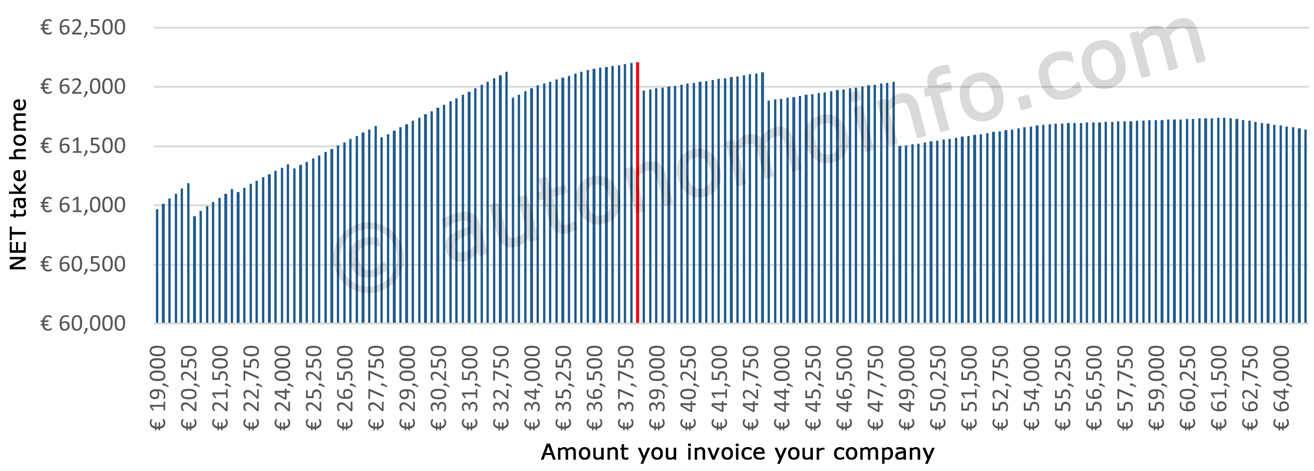

*For the annual net profit above, this is the optimal amount (in terms of NET take home) to invoice your company in Catalonia if you are single, without kids, and without disability.

Example 2: Net profit of €60,000

| Autónomo | Company | ||

|---|---|---|---|

| Income | € 60,000 | Income (you invoice your company)* | € 38,250 |

| Income tax (IRPF) | € 16,536.25 | Income tax (IRPF) | € 8,584.19 |

| Social security | € 5,462.16 | Social security | € 4,418.82 |

| Civil liability insurance | € 238.00 | Company bookkeeping | € 800.00 |

| Remaining profit in company | € 20,950.00 | ||

| Corporation tax on profit (23%) | € 4,818.50 | ||

| Left to take out as dividends | € 16,131.50 | ||

| Captial gains tax on dividends | € 3,348.27 | ||

| Total tax | € 16,536.25 | Total tax (IRPF+Corp.+Cap. gains) | € 16,750.96 |

| NET take home | € 37,763.59 | € 38,030.22 | |

*For the annual net profit above, this is the optimal amount (in terms of NET take home) to invoice your company in Catalonia if you are single, without kids, and without disability.

Example 3: Net profit of €100,000

| Autónomo | Company | ||

|---|---|---|---|

| Income | € 100,000 | Income (you invoice your company)* | € 38,250 |

| Income tax (IRPF) | € 34,216.25 | Income tax (IRPF) | € 8,584.19 |

| Social security | € 6,505.50 | Social security | € 4,418.82 |

| Civil liability insurance | € 238.00 | Company bookkeeping | € 800.00 |

| Remaining profit in company | € 60,950.00 | ||

| Corporation tax on profit (23%) | € 14,018.50 | ||

| Left to take out as dividends | € 46,931.50 | ||

| Captial gains tax on dividends | € 9,970.27 | ||

| Total tax | € 34,216.25 | Total tax (IRPF+Corp.+Cap. gains) | € 32,572.96 |

| NET take home | € 59,040.25 | € 62,208.22 | |

*For the annual net profit above, this is the optimal amount (in terms of NET take home) to invoice your company in Catalonia if you are single, without kids, and without disability.

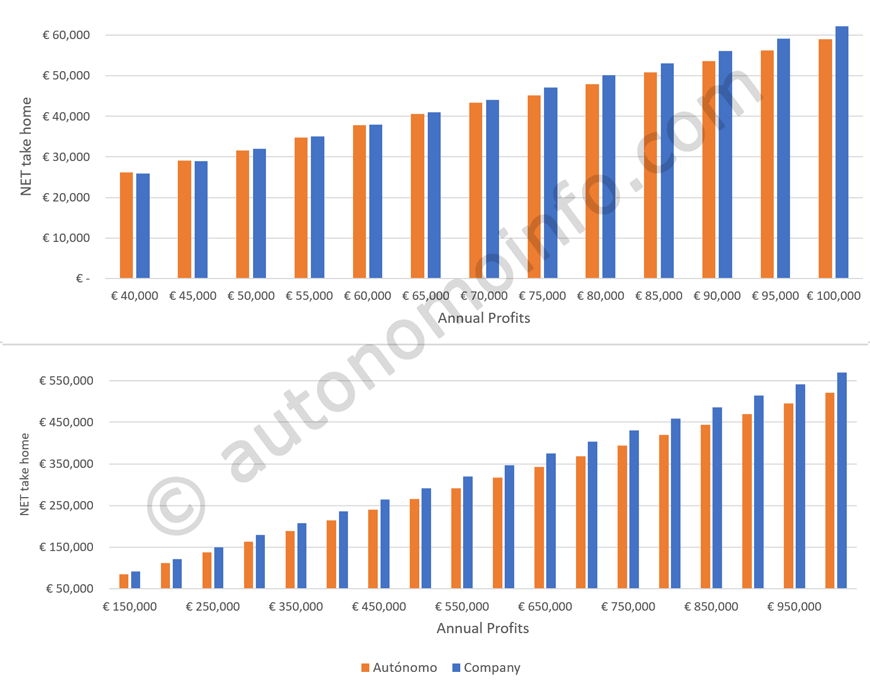

The figure below shows how your NET take home varies for annual profits ranging from €40,000 to €1 million, both as a regular autónomo and a company owner.

Conclusion

In summary, assessing the financial implications reveals that adopting a company structure in Spain yields tangible fiscal benefits only when annual profits consistently exceed €60,000. However, even with a significant profit margin, such as €100,000, the savings on taxes and social security contributions are relatively modest, just over €3,000 annually. This marginal financial gain must be weighed against the costs associated with establishing and dissolving a company, increased administrative responsibilities, and the impact on short-term cash flow due to VAT and withholding tax. Additionally, about 2/3 of the above savings are due to lower social security contributions which translate to lower pension and other benefit payments (sick and unemployment), which is an important consideration.

VERDICT: Purely from a financial standpoint, forming a company may not be justifiable for an individual professional in Spain unless your profits are in the high six figures. Otherwise the savings are minimal and offset by potential drawbacks, including diminished future pension and benefits.

Reason 3: You are trying to attract some bigger clients who maybe prefer to deal with companies rather than self-employed individuals

On the other hand, the decision to form a company may not solely depend on liability or financial considerations. From a business development perspective, operating as a company could appeal to larger clients or institutions that prefer or require engaging with corporate entities over individual freelancers for reasons ranging from liability concerns to corporate policy. While a regular autónomo with adequate civil liability insurance might offer sufficient protection, the perceived credibility and professionalism of a company can be advantageous in attracting certain clients.

VERDICT: Ultimately, the choice to form a company hinges on personal circumstances, anticipated revenue, and the strategic value of presenting oneself as a corporate entity. The potential benefits in client perception and market opportunities must be balanced against the increased operational complexities and costs associated with maintaining a company.