Cómo estimamos las cuotas para 2026-2031

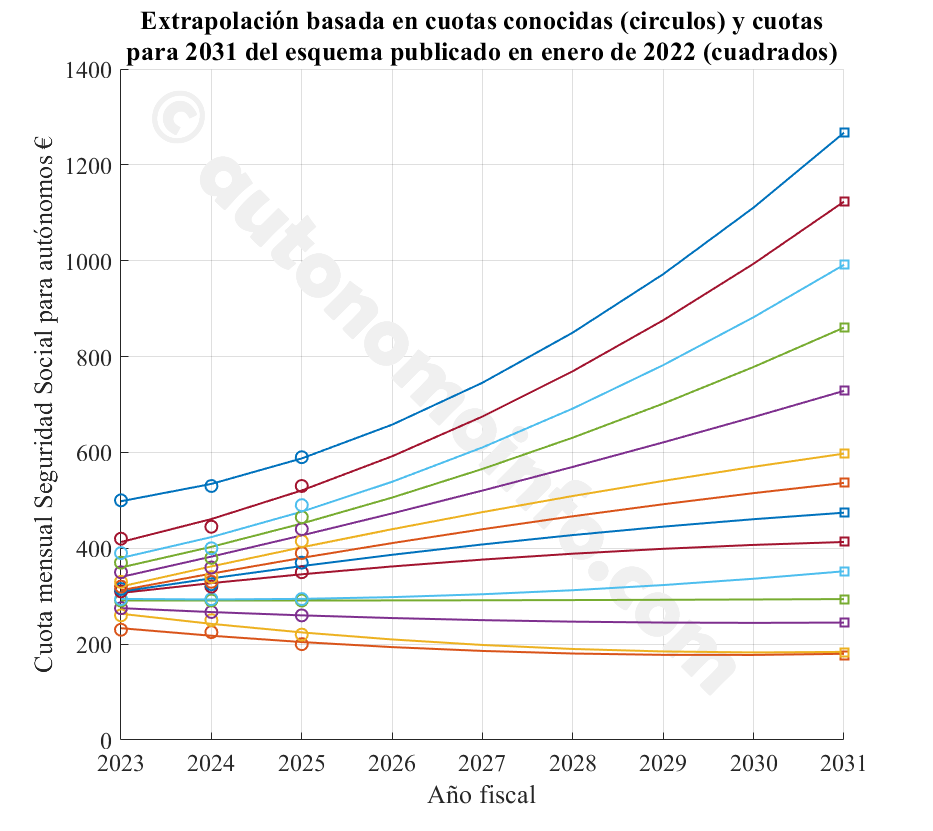

En 2022 el gobierno español ha puesto en marcha un plan para aumentar progresivamente las cotizaciones de los autónomos a la Seguridad Social durante un periodo transitorio de 9 años desde 2023 hasta 2031. Por ahora, el Gobierno solo ha publicado las nuevas cotizaciones para los años 2023-2025, mientras que los valores para los años siguientes no se conocerán hasta 2025. Pese a ello, nuestra calculadora te permite utilizar años fiscales hasta 2031, el último año del período de transición. A continuación te explicamos cómo las estimamos.Antes de que se aprobara el esquema actual, el gobierno ya indicó cómo quiere incrementar las contribuciones hasta 2031. El esquema propuesto por el gobierno fue publicado en un artículo en El País. Si bien este esquema ya ha cambiado, proporciona una indicación de dónde potencialmente llegarían las cotizaciones al final del período de transición en 2031. Con el fin de estimar las contribuciones para los años 2026-2031, usamos los años ya conocidos (2023-2025), usamos las cuotas para 2031 del esquema publicado en El País, y aplicamos una regresión de mínimos cuadrados (mejor ajuste) de una ecuación polinómica de segundo grado para obtener los años intermedios 2026-2030. El resultado se muestra a continuación.

Obviamente, en este momento estos datos son altamente especulativos y solo pretenden proporcionar una indicación de hacia dónde podrían dirigirse las cosas después de 2025.

Seleccione lo que se aplica a ti para determinar tu mínimo personal y familiar

Calcula tu renta/IRPF y la nueva cuota de autónomos que debes pagar a la Seguridad Social a partir de 2023

Clica para mas información sobre el sistema de autónomos en España

Si eres autónomo en España, hasta 2022 pagabas una cuota fija mensual entre ~300€ y ~1250€ al sistema de la Seguridad Social. La cuota no estaba vinculada a tus ingresos y se podía elegir libremente dentro de dicho rango; básicamente, cuanto mayor era la cuota que elegías, mayores eran tus beneficios (pago por enfermedad, beneficio por desempleo, pensión).

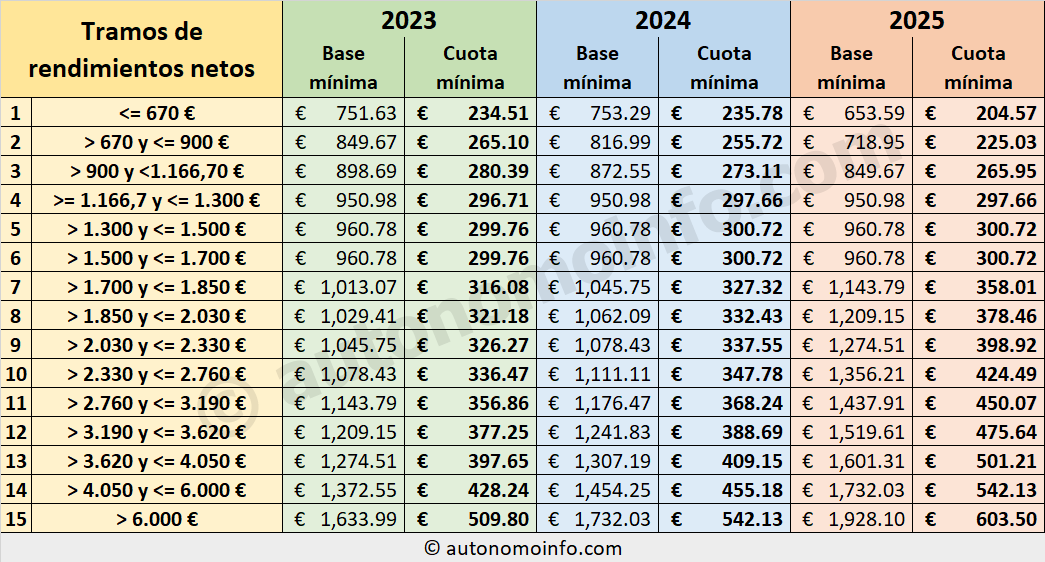

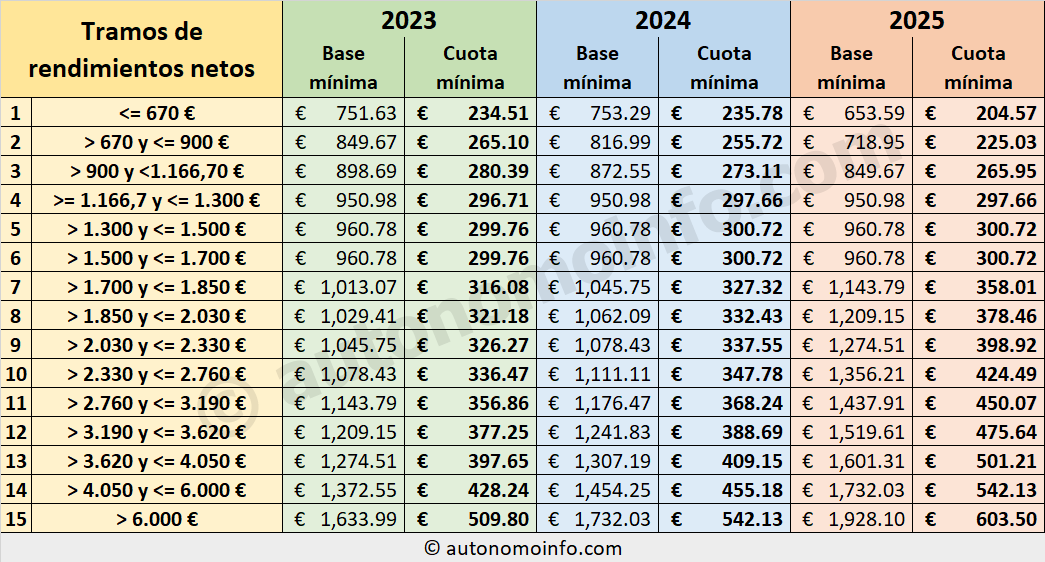

En 2022 el gobierno español ha puesto en marcha un plan para aumentar progresivamente las cotizaciones de los autónomos a la Seguridad Social durante un periodo transitorio de 9 años desde 2023 hasta 2031. Por ahora, el gobierno solo ha publicado las nuevas cotizaciones para los años 2023-2025. El principal cambio es que en el nuevo sistema los pagos mínimos a la Seguridad Social ya no están desvinculados de tus ingresos. El nuevo esquema utiliza 15 tramos fijos de ingresos para determinar tu contribución mínima a la Seguridad Social.

Las nuevas cuotas mínimas para autónomos y bases de cotización del nuevo sistema de cotización por rendimientos netos. Importante: los "rendimientos netos" que se muestran en esta tabla ya incluyen la deducción por gastos generales (del 7%/3%) y, por lo tanto, son diferentes de los "rendimientos netos" del formulario a continuación.

Ten en cuenta que es una aproximación porque la declaración de la renta no depende solo de tu actividad económica sino de todos tus ingresos, por lo que si has tenido otros ingresos o trabajas también por cuenta ajena, el resultado solo se corresponderá y de forma aproximada con tu actividad como autónomo.

En 2022 el gobierno español ha puesto en marcha un plan para aumentar progresivamente las cotizaciones de los autónomos a la Seguridad Social durante un periodo transitorio de 9 años desde 2023 hasta 2031. Por ahora, el gobierno solo ha publicado las nuevas cotizaciones para los años 2023-2025. El principal cambio es que en el nuevo sistema los pagos mínimos a la Seguridad Social ya no están desvinculados de tus ingresos. El nuevo esquema utiliza 15 tramos fijos de ingresos para determinar tu contribución mínima a la Seguridad Social.

Ten en cuenta que es una aproximación porque la declaración de la renta no depende solo de tu actividad económica sino de todos tus ingresos, por lo que si has tenido otros ingresos o trabajas también por cuenta ajena, el resultado solo se corresponderá y de forma aproximada con tu actividad como autónomo.

Usa esta herramienta para calcular cuánto tendrás que pagar en contribuciones a la Seguridad Social y en impuestos (IRPF) con el nuevo sistema de autónomos en España introducido en 2023 y cómo esto afecta a tus ingresos netos en comparación con el sistema anterior.

Todo el contenido © AUTONOMOINFO.COM 2026